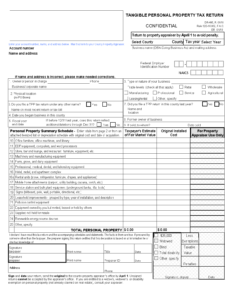

Please contact our Tangible Personal Property Department at (904) 827-5500 if you have any questions or need additional information.

If this is the first year you have been in business or you have not filed before please visit here to create your TPP account.

CALL (904) 827-5500

EMAIL sjcpa@sjcpa.gov

2024 Holiday Schedule