If you’re looking to purchase a new home or have recently bought a new home, it is important to calculate your property taxes. Your property taxes will differ from the previous owner’s property taxes because all caps and exemptions are removed once ownership changes.

The most accurate way to estimate your home’s or potential home’s property taxes is to use the tax estimator available on this website. The online tax estimator utilizes the most recently certified millage rates, typically from the preceding tax roll year, to create an estimate of property taxes. Non-ad valorem assessments are based on those most recently assessed to the parcel being estimated. These assessments are subject to change and may be higher or lower in the next tax year.

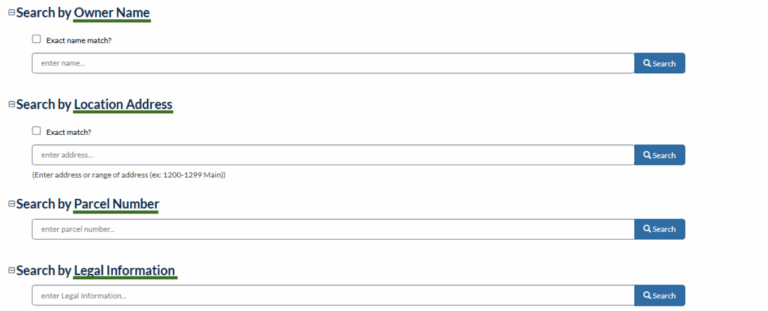

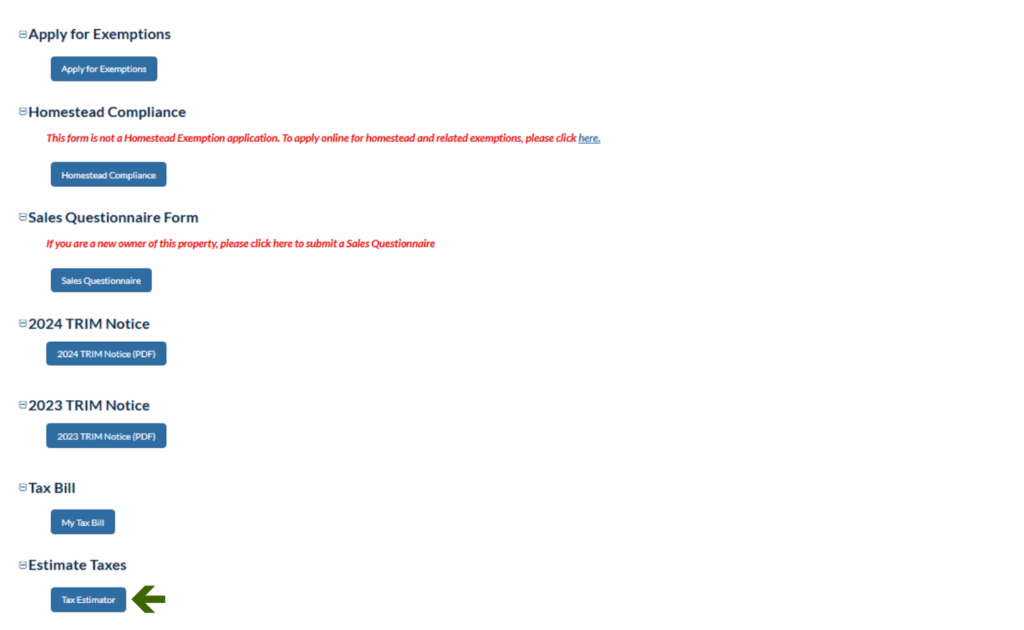

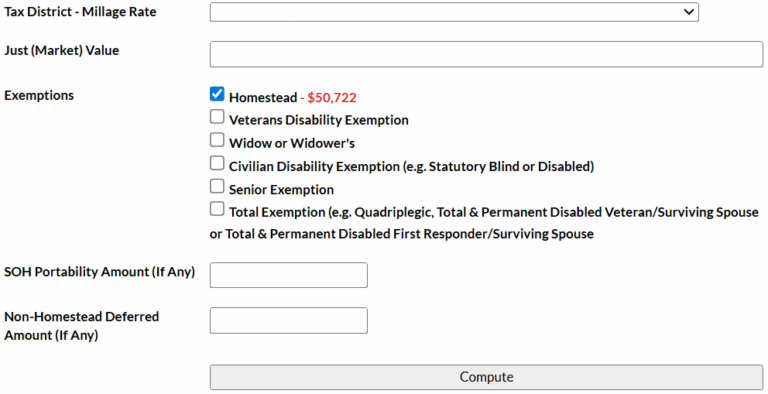

Here are the steps to use our online tax estimator. Images of the property search and tax estimator screens are used below for reference.

Navigate to the Search Property page on this website by clicking the below button and then following these steps.

2.

Search for the property you’re looking to purchase or have recently purchased by typing in the owner name, address, parcel number or legal information and then clicking search.

3.

Once on the property information page, select Tax Estimator under Estimate Taxes.

4.

The Tax Estimator will prepopulate with the property’s information, including the Tax District.

5.

Click Compute. The Tax Estimator will provide an estimate of property taxes and non-ad valorem taxes, which include CDD fees (if applicable) and solid waste fees.

CALL: (904) 827-5500

EMAIL: sjcpa@sjcpa.gov

2025 Holiday Schedule

Under Florida law, e-mail addresses are public records. If you do not want your e-mail address released in response to a public records request, do not send electronic mail to this entity. Instead, contact this office by phone or in writing.