Portability, also known as Save Our Homes, is a benefit provided to homesteaded property owners in Florida that enables them to transfer their accumulated tax savings from one homesteaded property to another within the state. The portability benefit could be significant for those who have been in their home for a number of years.

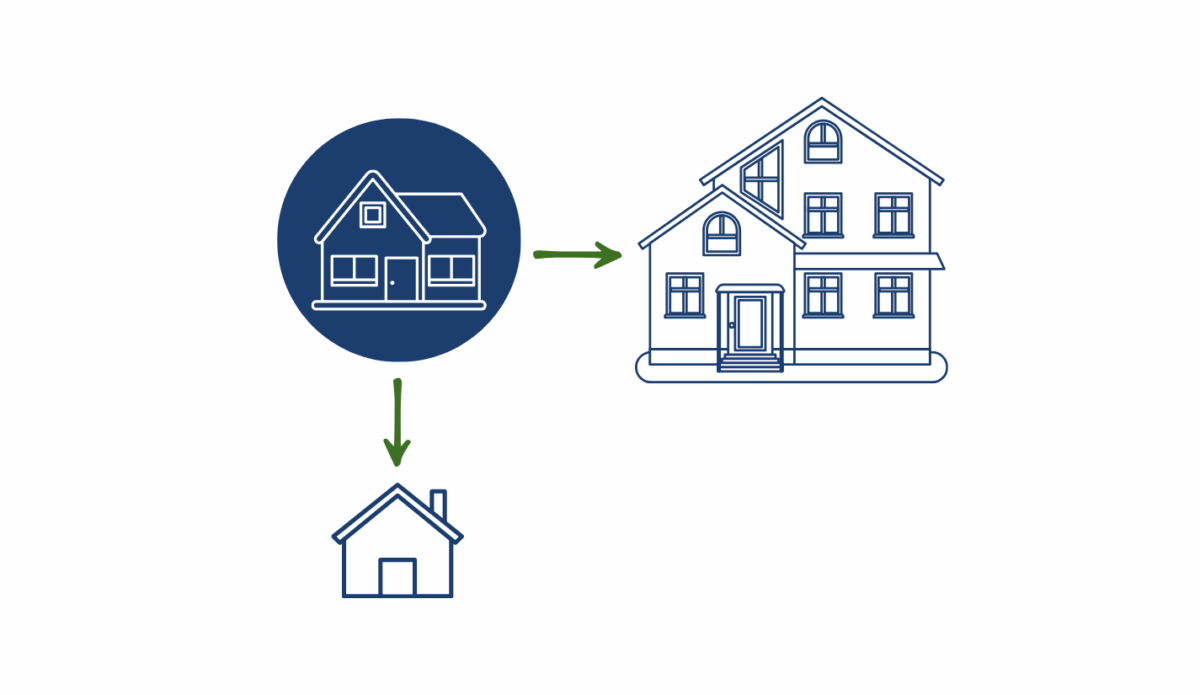

Portability allows the homesteaded property owner to transfer the accumulated difference between the previous property’s just (market) value and assessed value to another homesteaded property. Just (market) value is a property’s probable sale price in a competitive market as of Jan. 1 of this year. Assessed value is the just (market) value limited by the Save Our Homes statutory caps, which is up to 3% for homesteaded properties. If the just (market) value increases more than 3% annually, then the portability benefit begins to increase each year, creating a tax savings for the homeowner.

The maximum portability amount that can be transferred is $500,000. If the property owner purchased a home with an equal or higher just (market) value from their previous home, then they can transfer all of their portability benefit, up to $500,000. If the property owner purchased a home with a lower just (market) value than their previous home, then they can transfer a proportionate amount, up to $500,000. For example, if the new home is valued at 50% less than the previous home, then 50% of the portability benefit is transferrable.

Portability must be transferred within three tax years (January through December) once a homestead has been relinquished. It is important to note that when a homestead is relinquished in December, that is considered one tax year. Also, portability can be used an unlimited number of times.

For St. Johns County properties, the portability total can be found by looking at the property’s Truth in Millage (TRIM) notice here on our website or by calling our office. For properties located outside the county, contact that county’s property appraiser’s office for details.

Our team is available to answer any questions by phone at 904-827-5500 or by stopping in our office. Also, additional information about portability is available at www.sjcpa.gov/portability.